My original NFL Season Wins article was my most-viewed post of 2020 and one that I’ve been asked quite a few times to update. The most obvious change is that the season is now 17 games long instead of 16, but that’s a trivial update and you, my loyal readers, deserve something more.

Back in 2020, I used what’s typically described as a “top down” approach to finding the center point of each team’s probability distribution for their number of wins. I took the lines from a sharp book like Pinnacle or Circa and made the assumption that those lines are “efficient”; that is, that they form the most accurate possible prediction reflecting all information that is available at the time. As a consequence, +EV (or “alpha” as finance people call it) is impossible to achieve in the reference market, it’s only available in derivative markets like DraftKings alt totals. That efficiency assumption was easy, non-controversial and it allowed me to focus on more important stuff like the shape of the distribution around that center point.

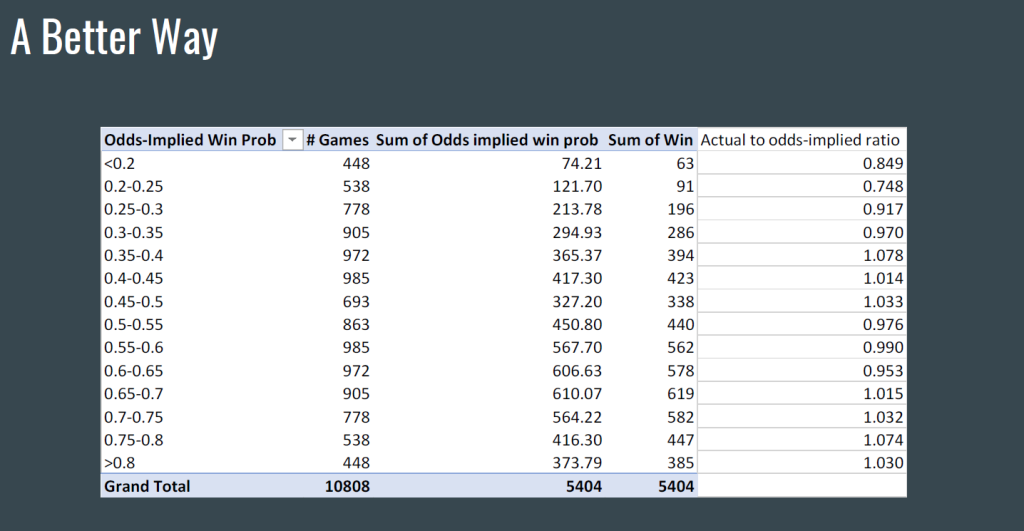

Earlier this year, I had the privilege of attending BetBash in Las Vegas. I met lots of amazing people, and I was honoured to be given the opportunity to speak as part of the analytics.bet seminar. I racked my brain to try to come up with a topic that would appeal to the audience of diverse backgrounds, abilities and betting styles. I ended up talking about a hybrid approach; something simple that top-down bettors tend to ignore because it’s too bottom-up, and that bottom-up bettors tend to ignore because it’s too top-down. It involves looking for predictive signal in the differences between what the market expected to happen and what actually happened. Here’s an example for a variable and a sport that I will not disclose:

Let’s apply this concept to the pricing of NFL season win totals. These are extremely complex markets to originate from scratch, so I’m not even going to try. Instead, let’s pick a few scenarios and see if we can spot any systematic bias in these markets. My data set includes NFL regular season win markets going back to 2015.

For inspiration I’m going to turn to some of my past work on quarterback ratings which showed that NFL quarterbacks typically underperform in their rookie years followed by a big jump in performance in year two.

| Team’s Week 1 Starting QB: | # Team/Seasons | Market Expected Team Wins | Actual Team Wins | Average Deviance (actual – expected wins per team per season) | Team Wins vs Market (over-under-push) |

| Rookie | 23 | 152.8 | 132 | -0.90 | 5-13-5 |

| 2nd year | 27 | 204.0 | 231 | +1.00 | 14-10-3 |

| 3rd+ year, first year with new team | 42 | 316.0 | 305 | -0.26 | 14-21-7 |

| None of the above | 132 | 1132.0 | 1133 | +0.01 | 58-64-10 |

| Total | 224 | 1804.8 | 1801 | -0.02 | 91-108-25 |

Sample sizes aren’t great, but you go to war with the data you have, not with the data you want…and the data I have seems to confirm the hypothesis. Teams starting rookie QBs underperformed their market win total by an average of 0.90 wins. Teams starting second year QBs outperformed their market win total by an average of a full win, and they went 14-10-3 to the over in a market where unders typically rule the day (see my 2020 article for an examination of the over bias).

Does this have any predictive value? There’s no way to know for sure. Statistical purists will say that the two-tailed T-tests give p-values of 0.12 and 0.07 for rookie and 2nd year respectively, and those are (in booming God voice) “NOT STATISTICALLY SIGNIFICANT!” But Bayesians like me don’t roll that way. The fact that there’s a narrative that points in the same direction as the data (rookie QBs are overhyped and overrated following college and the draft, the NFL has a steep learning curve) has to count for something. We’ll return to the questions of sample size and significance in a little bit.

Aside from the quarterback, the next most important factor in a team’s success or failure is arguably the coaching staff. Instead of trying to come up with a subjective ranking of coaches, let’s just look at new vs returning:

| Team’s Week 1 Coaching Staff: | # Team/Seasons | Market Expected Team Wins | Actual Team Wins | Average Deviance (actual – expected wins per team per season) | Team Wins vs Market (over-under-push) |

| New HC | 48 | 328.4 | 339 | +0.22 | 22-18-8 |

| Returning HC | 176 | 1476.4 | 1462 | -0.08 | 69-90-17 |

| New OC | 95 | 698.7 | 660 | -0.41 | 30-51-14 |

| Returning OC | 129 | 1106.1 | 1141 | +0.27 | 61-57-11 |

| New DC | 80 | 593.0 | 593 | +0.00 | 33-35-12 |

| Returning DC | 144 | 1211.8 | 1208 | -0.03 | 58-73-13 |

Both the head coach and the offensive coordinator metrics show some promise, but they really shouldn’t be treated as independent because there’s some correlation between the head coach being new and the rest of the staff being new as well.

| Team’s Week 1 Coaching Staff: | # Team/Seasons | Market Expected Team Wins | Actual Team Wins | Average Deviance (actual – expected wins per team per season) | Team Wins vs Market (over-under-push) |

| New HC, New OC | 43 | 328.4 | 339 | +0.27 | 19-16-8 |

| New HC, Returning OC | 5 | 36.7 | 36 | -0.19 | 3-2-0 |

| Returning HC, New OC | 52 | 407.2 | 357 | -0.97 | 11-35-6 (!!) |

| Returning HC, Returning OC | 124 | 1069.1 | 1105 | +0.29 | 58-55-11 |

So it seems like you want your head coach and your offensive coordinator to be either both new or both returning, not a mixture.

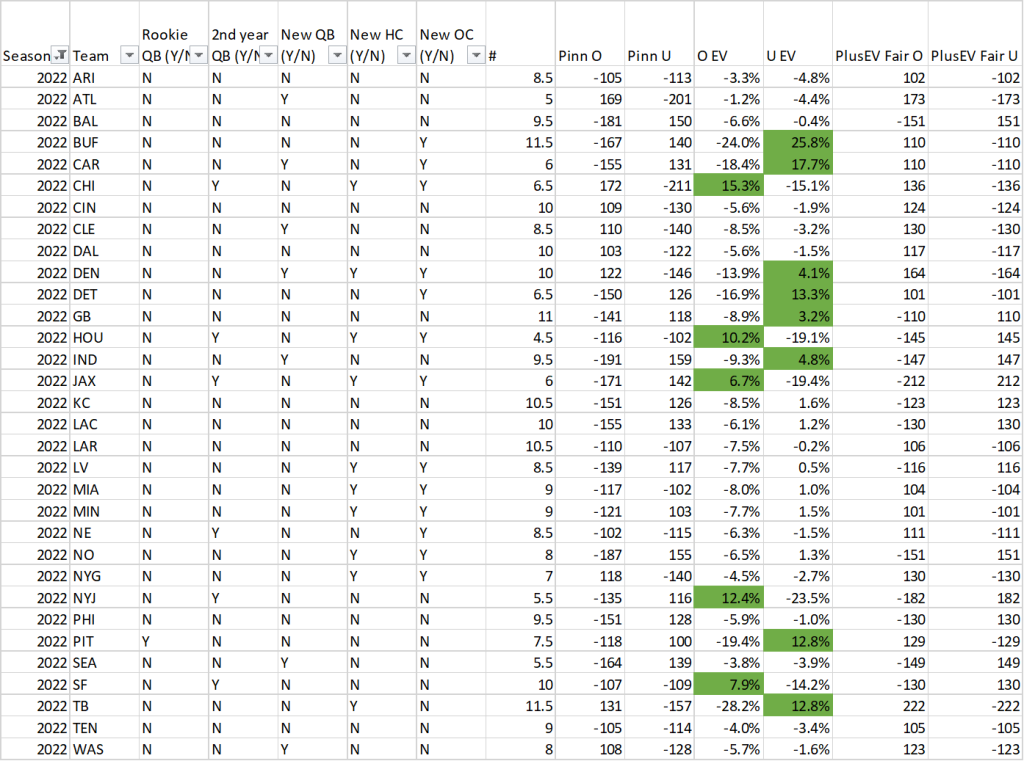

OK, so we have what looks like it may be some good signal on the quarterback and some good signal on the coaching staff…and it adds up quickly. A team with a rookie QB and a mixture of new/returning coaching staff would, according to this data, be expected to underperform their season win total by a whopping -1.87 wins. A team with a second year QB and an all-new or all-returning coaching staff would be expected to overperform their season win total by +1.28 wins (hello Bears, Texans, Jets, Niners and yes, Jaguars!) These are massive, massive numbers…but, they were built on such small sample sizes that it’s hard to be sure they’re real. Because we’re doing everything relative to market numbers, it’s easy to do “regression to market” by using, in our final model, some fraction of the signal that the raw numbers suggest. I’ve selected 50%.

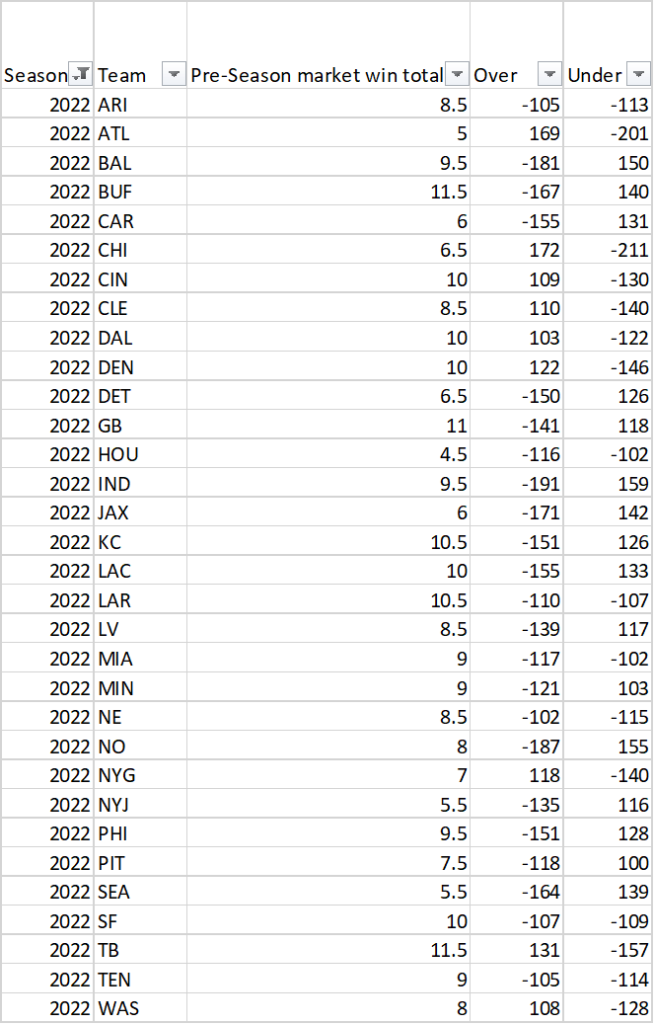

Time to get down to business. As my market reference, I’m using Pinnacle season win totals as of Aug 21:

The form of my model is the same as the one I used in 2020, but instead of anchoring to the raw market numbers I’m using the raw market numbers plus 50% of the signal from the QB and coaching staff factors as described above.

How much of an impact does this new “alpha” make? Even with the 50% scaling…quite a bit.

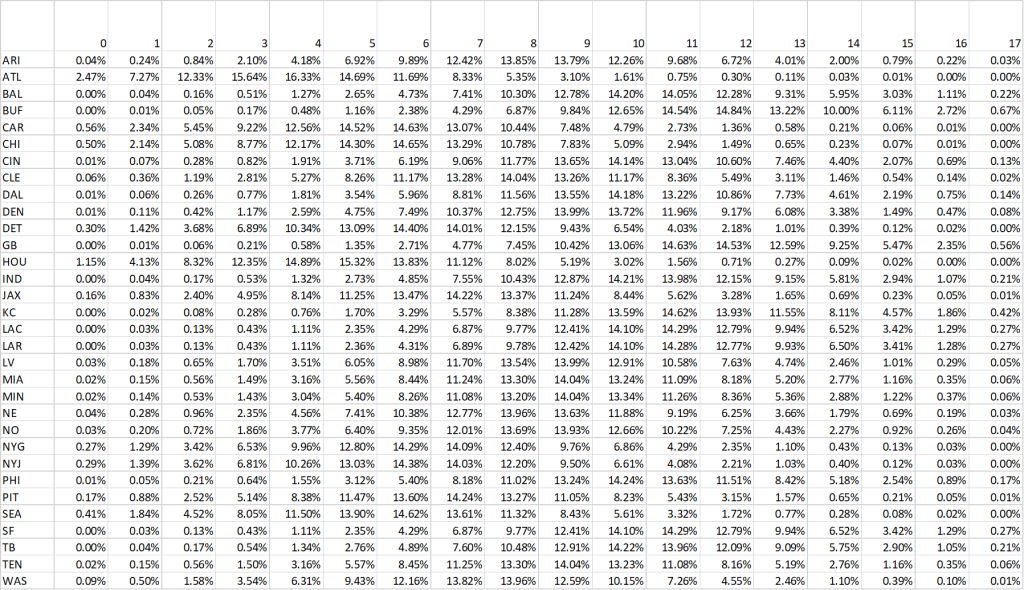

And here’s the entire distribution:

As with 2020, there’s value in some of the alt numbers as well, as books still aren’t fully pricing in the uncertainty as much as my model thinks they should be.

A few things I like, +20% and up at current numbers (you might be able to find even better numbers):

- Buffalo under 11.5 +140 (Pinnacle)

- Houston alt over 5.5 +200 (Caesars)

- Jacksonville alt over 7.5 +200 (DK)

- Jets alt over 6.5 +175 (Caesars)

- Tampa alt under 10.5 +175 (Caesars)

- Denver alt under 9 +180 (DK)

- Seattle alt over 6.5 +185 (DK)

Special thanks to Gabe Ostrander and Fabian Sommer for helping me with data collection for this project!

While using a beta-binomial distribution, improves upon a simple binomial, it seems to me that QB injury risk is a huge missing variable, and accounting for such injuries would go a long ways towards more accurately describing the distribution of team wins for a given team, although it would add a lot of complexity (and subjectivity around the value of a given QB). I would guess that there is a bimodality to parameter “p”, which when ignored might be understating the probability of results on the extremes. Would be interested to hear if you have thought about how this at all.

LikeLike